What is GST? What Are The Career Opportunities in GST (Tax domain)?

07, Apr 2022

The tax system in India has undergone tremendous changes since the introduction of GST. GST stands for Goods and Services Tax. This tax covers all kinds of goods and services available in the market. GST is categorized as an indirect tax which was introduced to replace numerous other indirect taxes. Earlier, taxes were levied on goods and services in multiple forms like excise duty, VAT (Valued Added Tax), services tax, and others.

The government of India decided to club all these taxes into a common tax head, hence the GST was introduced. The Goods and Services Tax was passed in parliament in the year 2017. GST is levied at every stage of the manufacturing and sale process and hence is a multi stage tax, unlike the other previous taxes. With tax being levied at every stage, we mean GST being charged at every point of sale.

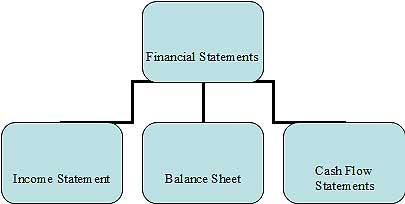

GST is charged right from the manufacturing of a product to the final sale of the product to the consumer. All the stages involved in the above chain can be defined as below:

- GST on purchase or sale of raw materials

- GST on purchase or sale to wholesalers

- GST on sale of products to the retailers

- GST on sale of products to the end consumers

Some of the Benefits of GST are stated below:

- Having a standard tax system across the entire country means that every city or state or region will be charged taxes based on a standard tax rate or slab for a particular product or service. That means if you want to buy soap in any region or city, the rate of tax charged to the person will be the same. Similarly, the government had defined slabs for tax rates, and every product or service falls under one of these tax slabs. One tax slab can have multiple products and services as well. Administration of tax becomes simpler and easier when the central government defines the tax rates and policies.

- One of the major impacts and benefits of the GST is that it eliminates the cascading effect of taxes. Due to numerous indirect taxes, taxpayers were unable to set off the tax paid against other taxes incurred on the same product and ended up paying different taxes on the entire amount. Under GST, the payer has to pay taxes only on the additional value during sale or supply. That means if GST has already been paid on the amount of raw materials, then the tax payable at the next stage will be on the additional amount over and above the cost or amount of raw materials. GST has also eliminated the need for multiple documentation at different stages.

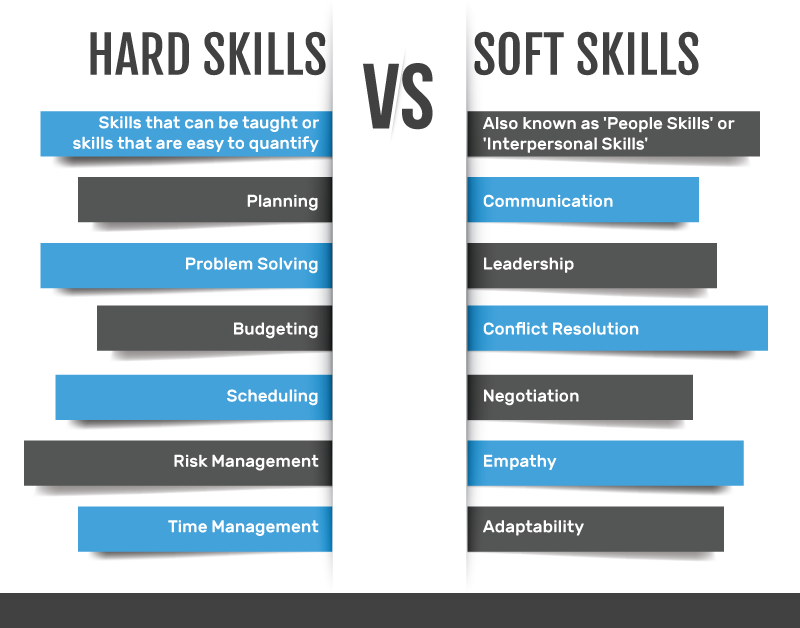

- The demand for professionals having skills and expertise in GST is increasing day by day. The major reason behind the ever increasing demand is that first, all the companies need to follow the GST guidelines and file GST on a periodical basis. The second reason is that since it’s a new concept as the rules, regulations, and laws related to GST are different, candidates need to have knowledge regarding the GST concept and need to stay up to date. Acquiring complete GST knowledge requires specialized training and guidance to learn the right and ethical practices. There are several institutions that provide training on GST. The programs could be focused either on GST only or could be professional courses in accounting that cover GST as a part or subject.

If you wish to know about professional courses or certification courses that focus on GST training, you can walk in at any of the EduPristine centers for a free counselling session.

Career Opportunities in GST (Tax domain):

There are numerous career options available after the GST certification course. Some of the job opportunities after GST or in the taxation field are as follows:

- Tax Manager – Every company requires professionals who can take care of tax related matters in the company. A Tax Manager looks after the direct and indirect taxes in the company. It is the responsibility of the Tax Manager to comply with all the tax due dates and policies and file taxes and tax returns regularly. Tax Managers are also responsible for planning tax strategies so that the company gets the maximum benefit from tax policies.

- Tax Research Analyst – The role of a Tax research Analyst is to proofread and verify contracts from the taxation point of view.

- Reconciliations – Organizations need professionals for reconciling their books of accounts as feeding wrong data for GST can have severe consequences.

- GST Compliance Practice – Complying with the GST rules is important for every organization. Hence some companies even appoint candidates specifically for looking into GST compliance.

- GST Consultancy Practice – Candidates can start their own consultancy services since there are a lot of organizations looking to outsource their tax work or seek advice.

- GST Department – There is a lot of demand for GST professionals in the GST department managed by the government as the workload has increased after the introduction of the new tax system.

- GST Trainer – Since there are numerous institutes providing training related to GST, there is also a need for GST trainers to provide high quality training to the students.

Feel free to reach us for GST course details and accounting course details like PGP-BAT course, PGP-BAT course scope, eligibility of PGP-BAT and other accounting courses, duration of accounting courses, etc.

Leave a Reply