Balance sheet explained in detail

What is Balance Sheet?

A balance sheet (also called the statement of financial position), can be defined as a statement of a firm’s assets, liabilities and net worth. It provides a snapshot of a business at a point in time. These are prepared at the end of an accounting period like a month, quarter or year end. Comparison of balance sheets over years helps to gauge the financial health of a business. It got its name as assets minus liabilities (net assets) must equal the owner’s equity (they must balance). Every business will generally need a balance sheet while applying for loans or grants, submitting taxes or seeking potential investors.

Balance sheet is based on the formula: Assets = liabilities + Net worth

Components of the Balance Sheet

The three major components of the balance-sheet that indicate what the company owns and owes are Assets, Liabilities and Owner’s Equity.

Assets:

Assets can be defined as the valuables that the company owns to benefit from or are used to generate income. They are the resources of the company that have future economic value. These are categorized into tangible and intangible assets. The tangible assets are further bifurcated into current, long term and other assets. The non tangible assets are trademark, copyrights, goodwill to mention a few.

Current assets include the cash, accounts receivable, prepaid expenses and all that can be converted into cash within a year.

Long term assets are also called fixed assets. They are distinguished from the current assets due to their longevity in generating revenues. All fixed assets except for land are shown on the balance-sheet at original cost less depreciation.

Liabilities:

Liabilities are debts owed by the business. These are claims of the creditors against the assets of the business. These are claims or obligations that arise out of past or current transactions. Liabilities are classified into current and long term liabilities.

Current liabilities are accounts payable, accrued expenses, taxes payable, the current due within one year portion of long term debt and any other obligations due within a year.

Long term liabilities are debts that must be repaid by the business in more than one year from the date of the balance sheet.

Net worth (Owner’s Equity): Owner’s equity (called when it’s sole proprietorship) sometimes is also referred to as the book value of the company because owner’s equity is equal to the reported asset minus the reported liability.

Assets = liabilities + Net worth, this can be reposed to yield the definition of net worth, which is the balance after the liabilities are subtracted from the assets of the business.

This section of the balance sheet includes:

- Paid up capital

- Retained earnings

- Treasury stock

Preparing a Balance Sheet

The two most common formats of reporting the balance sheet are the vertical balance sheet (where all line items are presented down the left side of the page) and the horizontal balance sheet (where asset line items are listed down the first column and liabilities and equity line items are listed in a later column). The vertical format is easier to use when information is being presented for multiple periods.

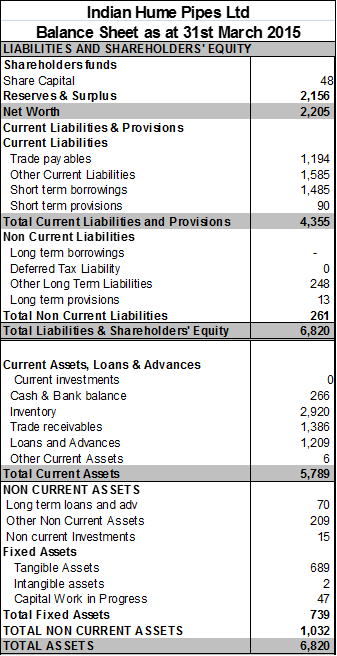

Example of Balance Sheet

What can be analysed from a Balance Sheet?

- The general financial state of the business at a specific point in time

- The amount of capital retained in the business

- The productivity, growth and solvency of the business

- The pace at which the assets can be converted to capital

Advantages of reporting the balance sheet

- Business snapshot:

Balance Sheet provides an accurate picture of the business status. While the profit and loss statement provides the profit made in a transaction, balance sheet gives the details of the bills the business owes to the vendors. Every balance sheet is unique; while a business may experience a high profit account, it can simultaneously have a poor balance sheet if the total net asset value is low and vice versa. Balance sheet determines the financial strength of a business and helps in future financial planning.

- Provides information for apt decision making:

Balance-Sheet provides the investors and potential lenders with the information needed to take decisions while lending money or resources. It reflects the company’s ability to collect and pay debts on time. On the basis of this, one can form an opinion of the company’s risk and return prospects.

- Provides helpful financial ratios:

Balance Sheet helps to calculate the ratios to determine a company’s long-term profitability and short-term financial outlook. Ratios like the current ratio and the acid test or liquidity ratio are calculated using information from the balance sheet. These ratios help obtain a very thorough summary of the company’s financial health by analyzing its cash position, working capital, liquidity and leverage. It also provides insight into the company’s likelihood of defaulting on its credit obligations or even its bankruptcy risk.

Disadvantages of the balance sheet

- Numbers could be misleading:

As the balance-sheet gives the financial snapshot at a given point of time, it could be misleading sometimes. For e.g. the analysis could get distorted if the company’s cash position at year end is high, indicating high reserves, but the company may intend to distribute it in the form of dividends.

- Doesn’t give true value of assets:

The balance sheet does not provide the true value of the assets as they are reported at the historical costs. It does not reflect the current market valuation.

- Other limitations:

The balance sheet has some of the current assets valued on estimated basis, so it does not reflect the true

financial position of the business. Also there is complete omission of the valuable non monetary assets from the

balance-sheet.

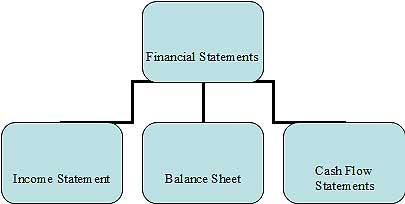

A Balance Sheet is one of the major financial statements that is required in a company to assess the performance and financial position of the organization. Every Accountant or a person who wishes to pursue a career in accountancy is expected to know to create and analyze a Balance Sheet along with other important financial statements.

Every course related to Accounts or Finance covers the basics of accounting. Be it a certification course in Accounts or Finance, a Diploma in Accounts or Finance, or a Bachelors degree in Accounts or Finance, a Balance Sheet is covered in each and every course. But any of these short term to long term courses do not provide core specialization in Accounting or Finance.

Here are some courses you can pursue that cover all the aspects of Accounting and Finance, providing lucrative career opportunities in India and abroad.

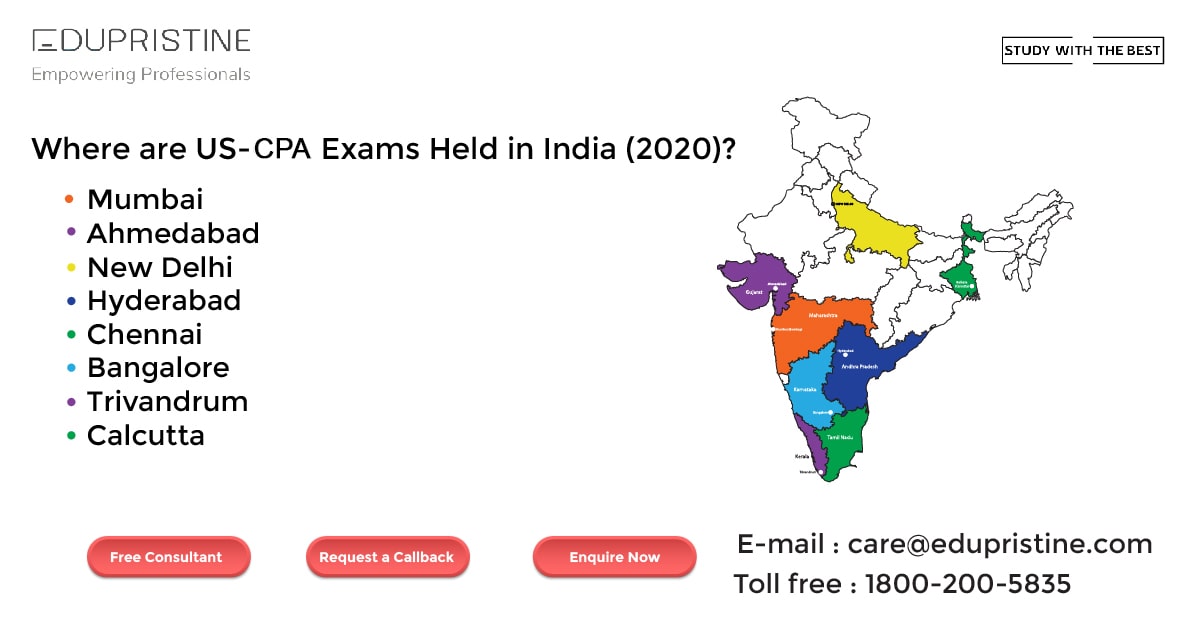

- Certified Public Accountant (CPA) – The CPA course is the most extensive course in accounting and offers lucrative job opportunities in the accounting segment. To know more about the US CPA eligibility, US CPA duration, US CPA fees, contact our counselors.

- Chartered Financial Analyst (CFA) – The Chartered Financial Analyst course covers all the aspects of the finance domain. CFAs are in high demand in Equity Research companies, Investment Banking companies, and many other banking and non banking institutions. To know more about the CFA eligibility, CFA duration, CFA fees, contact our counsellors.

Balance-sheet is one of the essential financial statements needed to take appropriate and sound financial decisions. Blended with the other components (Profit and Loss Statement, Cash Flow Statement and Statement of Owner’s Equity) of financial reporting, one can decide whether the business under focus is right as an investment option.

MAKE YOUR CAREER IN

Need more Info?

Tags

- ABOUT CFA COURSE

- ABOUT FRM COURSE IN INDIA

- ABOUT THE US CPA COURSE

- ACCA

- ACCA CERTIFICATION

- ACCA COURSE

- ACCA COURSE DETAILS

- ACCA COURSE DURATION

- ACCA COURSE ELIGIBILITY

- ACCA COURSE ELIGIBILITY CRITERIA

- ACCA COURSE ELIGIBILITY IN INDIA

- ACCA COURSE FEES

- ACCA COURSE FEES IN INDIA

- ACCA COURSE IN INDIA

- ACCA COURSE STRUCTURE

- ACCA COURSE STRUCTURE AND FEES IN INDIA

- ACCA COURSE SUBJECTS

- ACCA COURSE SYLLABUS

- ACCA EXAM STRUCTURE AND PATTERN

- ADMISSION TO CFA

- AI-POWERED FRAUD DETECTION IN ACCOUNTING

- APPLICATIONS OF AI IN ACCOUNTING

- AUDITING AND COMPLIANCE

- AUTOMATED DATA ENTRY

- AUTOMATED DATA ENTRY AND PROCESSING

- BAT COURSE

- BEST FINANCIAL MODELING COURSE

- BEST FINANCIAL MODELING COURSE IN INDIA

- BEST ONLINE CFA PREP COURSE

- BEST ONLINE FINANCIAL MODELING COURSE

- CAREER OPPORTUNITIES FOR CPA

- CERTIFICATION

- CERTIFIED FINANCIAL PLANNER (CFP®) COURSE

- CERTIFIED FINANCIAL PLANNER®

- CERTIFIED FINANCIAL PLANNER® PROGRAM

- CFA

- CFA CERTIFICATION

- CFA COURSE

- CFA COURSE CURRICULUM

- CFA COURSE DETAILS

- CFA COURSE DURATION

- CFA COURSE FEES

- CFA COURSE FEES IN INDIA

- CFA COURSE FULL DETAILS

- CFA COURSE IN INDIA

- CFA COURSE IN INDIA CFA COURSE CFA COURSE DETAILS CFA COURSE SUBJECTS

- CFA COURSE SUBJECTS

- CFA COURSE SYLLABUS

- CFA COURSE TRAINING

- CFA CURRICULUM

- CFA FOUNDATION COURSE

- CFP CERTIFICATION

- CFP COURSE

- CFP COURSE DETAILS

- CFP COURSE FEE

- CFP COURSE FEES IN INDIA

- CFP EXAM

- CFP® COURSE FEES

- CFP® COURSE SYLLABUS

- CFP® ELIGIBILITY

- CMA COURSE

- CMA COURSE DETAILS

- CMA COURSE DETAILS IN INDIA

- CMA COURSE DURATION.

- CMA COURSE ELIGIBILITY

- CMA COURSE ELIGIBILTY

- CMA COURSE FEES

- CMA COURSE FULL DETAILS

- CMA COURSE IN BANGALORE

- CMA COURSE IN INDIA

- CMA COURSE SUBJECTS

- CMA COURSE SYLLABUS

- CMA ONLINE COURSE

- CPA ACCOUNTANT

- CPA COURSE

- CPA COURSE DETAILS

- CPA COURSE DURATION

- CPA COURSE ELIGIBILITY

- CPA COURSE FEES

- CPA COURSE FEES IN INDIA

- CPA COURSE IN INDIA

- CPA COURSE STRUCTURE

- CPA COURSE SYLLABUS

- CPA EXAM

- EVOLUTION OF AI IN ACCOUNTING

- EVOLUTION OF AI IN FINANCE

- FINANCIAL MODELING

- FINANCIAL MODELING AND VALUATION

- FINANCIAL MODELING AND VALUATION COURSE

- FINANCIAL MODELING COURSE

- FINANCIAL MODELING COURSE CURRICULUM

- FINANCIAL MODELING COURSE DETAILS

- FINANCIAL MODELING COURSE FEE

- FINANCIAL MODELING COURSE IN INDIA

- FINANCIAL MODELING COURSE USEFUL

- FINANCIAL MODELING COURSE WITH PLACEMENT

- FINANCIAL MODELLING COURSE

- FINANCIAL MODELLING COURSE DURATION

- FINANCIAL MODELLING COURSE FEES

- FINANCIAL MODELLING COURSE ONLINE

- FINANCIAL RISK MANAGER

- FM COURSE & FRM® COURSE

- FRM

- FRM COURSE

- FRM COURSE CERTIFICATION

- FRM COURSE CURRICULUM

- FRM COURSE DETAILS

- FRM COURSE DURATION

- FRM COURSE ELIGIBILITY

- FRM COURSE FEES

- FRM COURSE IN INDIA

- FRM COURSE SYLLABUS

- FRM® COURSE SUBJECTS

- FRM® COURSE SYLLABUS & HOW TO APPLY FOR FRM® COURSE

- IN FINANCE

- PG PROGRAM IN BUSINESS ACCOUNTING & TAXATION

- PGP BAT COURSE FEES

- PGP BAT COURSE SALARY IN INDIA

- PGP-BAT COURSE

- PGP-BAT COURSE COURSE IN INDIA

- PGP-BAT COURSE DETAILS

- PGP-BAT COURSE DURATION

- PGP-BAT COURSE ELIGIBILITY

- PGP-BAT COURSE FULL FORM

- PGP-BAT COURSE IN INDIA

- PGP-BAT COURSE INSTITUTE IN INDIA

- PGP-BAT COURSE SYLLABUS

- PLACEMENTS TO CFA

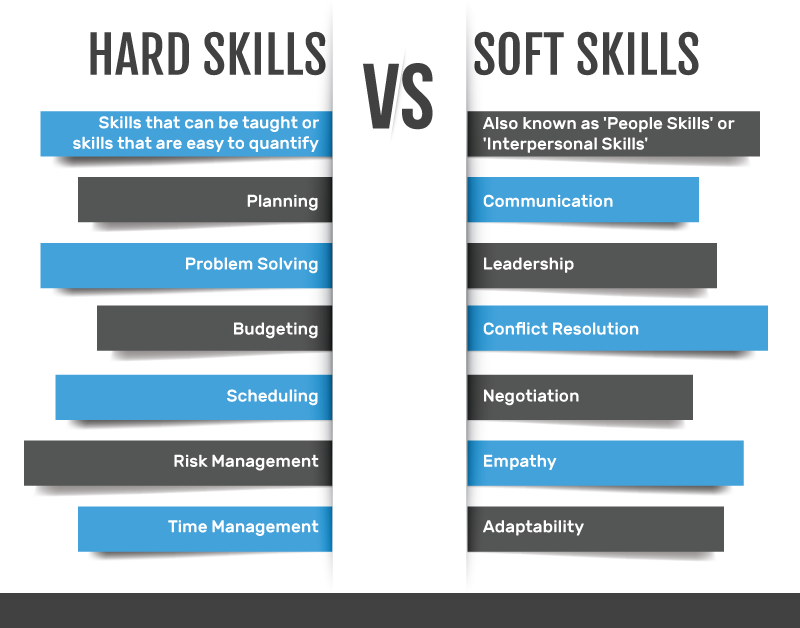

- SOFT SKILLS

- TAX PREPARATION

- TAX PREPARATION AND PLANNING

- US CMA COURSE

- US CMA COURSE DETAILS

- US CMA PREPARATION

- US CPA COURSE

- US CPA COURSE DETAILS

- US CPA COURSE FEES

- US CPA COURSE FULL FORM

- US CPA COURSE TRAINING

- US CPA EXAMS

- US CPA MEANING

- US-CMA

- US-CPA

- WHAT IS ACCA COURSE

- WHAT IS CFP® CERTIFICATION?

- WHAT IS CMA COURSE

- WHAT IS CPA COURSE

- WHAT IS FINANCIAL MODELING ALL ABOUT

- WHAT IS FINANCIAL MODELING COURSE

- WHAT IS FRM® COURSE? FRM® COURSE DETAILS

- WHAT IS FRM® COURSE? FRM® COURSE REVIEW

- WHAT IS THE CPA COURSE

- WHAT IS US CPA COURSE?

- WHAT IS US-CMA COURSE

related blogs

Will CMA Online Classes Help You Pass the CMA Exam

Hello, and welcome back to our new blog. Are you preparing to take on the Certified Management Accountant (CMA) journey Read More

Key Insights for CFP® professionals from the 2024 Financial Planning Conclave.

Hello, and welcome back to our new blog. As the financial world continues to evolve, the need for qualified and Read More

What You’ll Learn in Financial Planning Education

CFP® Course Curriculum: What You’ll Learn in Financial Planning Education | EduPristine Welcome back learners to another blog post focusing Read More

Capital Investment Decision in CFA®

Capital Investment Decision in CFA® | EduPristine Welcome back, learners, to another insightful blog post on Capital Investment Decisions in Read More– Izkušnje in strategije za športno stave v Liraspin casino

Izkusite Liraspin casino: Strategije za športno stave Športno stave so priljubljen način, kako obogatiti svoje športne izkušnje. V svetu, kjer Read MoreStrategie e consigli per le scommesse sportive fantasy su Liraspin

Navigare il mondo delle scommesse sportive fantasy con Liraspin Il mondo delle scommesse sportive fantasy sta guadagnando sempre più popolarità, Read MoreStrategien für Fantasy-Sportwetten: Ein Leitfaden von Liraspin

Navigieren im Bereich Fantasy-Sportwetten mit Liraspin Fantasy-Sportwetten haben in den letzten Jahren an Popularität gewonnen. Ob Sie ein erfahrener Spieler Read More

Techniques Used by CFP Practitioners to Enhance Client Wealth.

Techniques Used by CFP® Practitioners to Enhance Client Wealth | EduPristine Welcome back, financial planning learners! Today’s blog will shed Read More

How to Become a CPA Without a Degree in Accounting.

Hello, and welcome back to our latest blog. Have you ever wondered if you could become a Certified Public Accountant Read More

How Critical is the Role of CFOs in Mergers and Acquisitions

How Critical is the Role of CFOs in Mergers and Acquisitions? Hello, and welcome back to our new blog. In Read More

The Role of Artificial Intelligence in Accounting and Finance | EduPristine

The Role of Artificial Intelligence in Accounting and Finance | EduPristine Welcome back, learners, to another blog post on the Read More

Role Of CFP® In Bridging the Financial Literacy Gap in India | EduPristine

Role Of CFP® In Bridging the Financial Literacy Gap in India | EduPristine Welcome back, readers, to another insightful blog Read More

A Day in The Life of a Financial Risk Manager ® (FRM®) | EduPristine

A Day in The Life of a Financial Risk Manager ® (FRM ®) | EduPristine Welcome back, readers, to another Read More

How Much Does an US CMA Professional Earn in India by EduPristine

How Much Does a US CMA Professional Earn in India? Hello, and welcome back to our new blog. Have you Read More

Advancing Your Career with a Certified Financial Planner (CFP®) Course | EduPristine

Advancing Your Career with a Certified Financial Planner (CFP®) Course | EduPristine Welcome back learners to another blog post on Read More

US CMA Certification: Helps You Transition into Management Roles

How the US CMA Certification Can Help You Transition into Management Roles? Hello, and welcome back to our new blog. Read More

How the CPA Course Opens Doors to Global Success by EduPristine

How the CPA Course Opens Doors to Global Success? Welcome to our latest blog! Ever wondered what it takes to Read More

Why is Internal Control Crucial for US CMAs | EduPristine

Why is Internal Control Crucial for US CMAs? Hey there, welcome back to our new blog. Have you ever wondered Read More

How Much Does an ACCA Professional Earn in India by EduPristine

How Much Does an ACCA Professional Earn in India? Hey there, so good to have you back again. Have you Read More

PGP-BAT Course Career Opportunities Guide by EduPristine

PGP-BAT Course Career Opportunities | EduPristine Welcome back, learners, to another blog post on the career options ahead of you Read More

The Power of Soft Skills in Financial Leadership (Part I) EduPristine

CFA, FM, and FRM: The Power of Soft Skills in Financial Leadership (Part I) | EduPristine Welcome back, learners, to Read More

How much is a US CPA professional entitled to earn in India?

How much is a US CPA professional entitled to earn in India? Ever thought how your earning potential would skyrocket Read More

The Essentials of Treasury & Liquidity Risk Management in FRM® Course

The Essentials of Treasury and Liquidity Risk Management in FRM® Course | EduPristine Welcome back, learners, to another insightful blog Read More

CMA Course: Unlocking Diverse Career Paths | EduPristine

CMA Course: Unlocking Diverse Career Paths | EduPristine Welcome back, learners, to another blog post on the career paths after Read More

SBI’s Wealth Management: A Growth Prospects for CFP Certified Experts.

How SBI's Wealth Management Creates Opportunities for CFP® - Certified Experts? Hello, and welcome back to our new blog. Have Read More

Can You Get into the Big 4 with the ACCA Qualification?

Can You Get into the Big 4 with the ACCA Qualification? Hi, great to have you back again. One of Read More

CPA License in India- A Game-Changer for Your Accounting Career

Why Earning a CPA License in India is a Game-Changer for Your Accounting Career Hello, so good to have you Read More

Understanding Payroll and Its Components by EduPristine

Understanding Payroll and Its Components by EduPristine Hello there, and welcome back to our latest blog post. Do you have Read More

Safeguarding Success: Tackling Operational Risk in FRM® Course | EduPristine

Safeguarding Success: Tackling Operational Risk in FRM® Course | EduPristine Welcome back, learners, to another insightful blog post on Operational Read More

US CPA Course: Unlocking Diverse Career Paths | EduPristine

The US CPA Course : Unlocking Diverse Career Paths | EduPristine Welcome back, learners, to another blog post on the Read More

Understanding Market Risk within FRM® Course EduPristine

The Pulse of the Market: Understanding Market Risk within FRM® Course Welcome back learners! In this blog post we are Read More

Financial Modelling Course Opportunities | EduPristine

Financial Modelling Course Opportunities by EduPristine Welcome back, learners! In this blog post, we'll explore how completing the financial modelling Read More

Is the ACCA Course Suitable for Working Professionals in India

Is the ACCA Course Suitable for Working Professionals in India? Hello again, and a very warm welcome to our new Read More

Which Path to Take- US CPA vs. Canada CPA?

Which Path to Take- US CPA vs. Canada CPA? Hello, and welcome back to our new blog. Have you ever Read More

Why Should BCom Graduates and Those with 0-2 Years of Experience Pursue the PGP-BAT Course at Edu Pristine

Why Should B.Com Graduates and Those with 0-2 Years of Experience Pursue the PGP-BAT Course at EduPristine? Hi, and welcome Read More

Why the ACCA Qualification is Gaining Popularity in India by EduPristine

Why the ACCA Qualification is Gaining Popularity in India? Hello and welcome back! Have you noticed the number of professionals Read More

ACA vs ACCA What’s the Difference? A guide by Edupristine

Associate Chartered Accountant (ACA) vs Associate of Chartered Certified Accountants (ACCA) Hey there, so good to have you back again. Read More

Ethical Decision Making in Financial Management | Edupristine

Ethical Decision Making in Financial Management Introduction The swift moving world of finance has the ability to have lasting influences Read More

Understanding the Time Value of Money – TVM

What is (TVM) Time Value of Money? The Time Value of Money (TVM) is a fundamental financial principle which asserts Read More

Guide on How to Study for the US CMA Exams | US CMA Course Full Details

Tips & Tricks to Study for the US CMA Exams? Hello, and welcome back to our new blog! We have Read More

CMA Advantages: Benefits of Classroom Training | CMA COURSE | EDUPRISTINE

Why EduPristine's Classroom Training Gives Students a Leading Advantage for CMA COURSE? It is so good to see you again. Read More

Guide to choose an Institute for US CMA program | EduPristine

How to choose an institute for the US-CMA program? Hello, and how have you been? Welcome back! If you have Read More

Core Differences: US CMA vs. Indian CMA

Indian CMA vs US CMA Hello, and welcome back to our new blog where we will be discussing the Indian Read More

The Critical Importance of Soft Skills for CPAs

The Critical Importance of Soft Skills for Certified Public Accountants Hello, and welcome back to our new blog. Have you Read More

Essential Soft Skills for CMAs | US CMA COURSE

Essential Soft Skills for CMAs | US CMA COURSE Hello, and welcome back to our new blog. Have you ever Read More

Guide to Expected Shortfall (ES) by EduPristine

What is Expected Shortfall (ES)? Expected Shortfall (ES) is a way to measure the risk of an investment portfolio focusing Read More

Guide to Choose an Institute for the ACCA Course

How to Choose an Institute for the ACCA course? Hi, so good to have you back again. If you have Read More

BEST INSTITUTE FOR US CPA COURSE IN INDIA | EDUPRISTINE

Hello, and welcome back to our new blog. If you have already decided to pursue the most prestigious US CPA Read More

Guide to Value at Risk (VaR) by EduPristine

What is Value at Risk (VaR)? Introduction Value at Risk (VaR) is a financial metric used to estimate the potential Read More

How to Choose an Institute for the PGP-BAT Program by EduPristine

How to Choose an Institute for the PGP-BAT Program? Hello, and welcome back. It feels great to see you again. Read More

US CPA Eligibility Criteria in India by EduPristine

What is the US CPA Eligibility Criteria in India? Hello, and welcome to our new blog. The ideal accounting candidates Read More

The Cost Involved in Pursuing the ACCA Qualification

What is the Cost Involved in Pursuing the ACCA Qualification? Hello! Welcome back to our new blog. Let me start Read More

Why EduPristine’s Classroom Training Gives PGP-BAT Students a Leading Advantage

Why EduPristine’s Classroom Training Gives PGP-BAT Students a Leading Advantage? Hello, and thank you for being back again. Haven’t we Read More

Why is the FM course gaining popularity in India | EduPristine

Why is the FM course gaining popularity in India? Introduction Hello dear readers, a very warm welcome to all of Read More

Why EduPristine’s Classroom Training Gives ACCA Students a Leading Advantage?

Why EduPristine’s Classroom Training Gives ACCA Students a Leading Advantage? Hello, and welcome to our new blog! If you have Read More

Why is the CFA® course gaining popularity in India | EduPristine

Why is the CFA® course gaining popularity in India? Introduction Hello and welcome back to this brand-new blog where we Read More

Public Accounting vs. Corporate Accounting by EduPristine

Public Accounting vs. Corporate Accounting: A Comprehensive Comparison Hey there, so good to have you back again. Are you at Read More

EduPristine: Empowering Tomorrow’s Finance and Accounting Leaders

EduPristine: Empowering Tomorrow's Finance and Accounting Leaders In a world where there is often a gap between what is taught Read More

Understanding Top Finance Skills Employers Value in 2024 | EduPristine

Understanding Top Finance Skills Employers Value in 2024 In the rapidly evolving landscape of finance, the skills demanded by employers Read More

The Essential Role of Financial Management and Its Purpose | EduPristine

The Essential Role of Financial Management and Its Purpose Hey there, so good to have you back again. Have you Read More

What is Financial Reporting and Why is it Important | EduPristine

What is Financial Reporting and Why is it Important? Hey there, so good to have you back again. Have you Read More

Mastering the Foundations of Accounting by EduPristine

Mastering the Foundations of Accounting Hey there, so good to have you back again! Have you ever wondered what lies Read More

All about Credit Risk: A Comprehensive Guide by EduPristine

All about Credit Risk: A Comprehensive Guide In the domain of finance, managing credit risk is pivotal for the stability Read More

The Critical Role of Performance Management | EduPristine

The Critical Role of Performance Management Hey there, so good to have you back again! Have you ever wondered why Read More

A Comprehensive Comparison of Power BI and Excel | EduPristine

A Comprehensive Comparison of Power BI and Excel Hey there, welcome back again! In today's data-driven world, the ability to Read More

CMA vs MBA: Choosing the Right Path for Your Career Growth

CMA Programa vs. MBA: Choosing the Right Path for Your Career Growth Hey there, so good to have you back Read More

Corporate Governance: A Comprehensive Guide by EduPristine

Corporate Governance: A Comprehensive Guide Welcome to our exploration of Corporate Governance! In this blog, we will delve into the Read More

A Guide to Mastering Payroll Management by EduPristine

Mastering Payroll Management: A Comprehensive Guide to Components, Compliance, and Accounting Entries Hey there, welcome back to our new blog. Read More

Data Analytics for Management Accountants – EduPristine

Data Analytics for Management Accountants Why Data Analytics Matter for Management Accountants Hey there, so good to have you back Read More

Investment Valuation: A Comprehensive Guide by EduPristine

Investment Valuation: A Comprehensive Guide Welcome to our comprehensive guide on investment valuation! In this blog, we'll break down the Read More

Mastering MS Excel: Empowering Accountants for Success | EduPristine

Mastering MS Excel: Empowering Accountants for Success. Hey there, welcome back to our new blog. In the intricate world of Read More

Different Payment Methods for Merger & Acquisition | EduPristine

Different Payment Methods for Merger & Acquisition In the ever-evolving landscape of business, Mergers and Acquisitions (M&A) stand as pivotal Read More

Internal vs External Financial Reporting by EduPristine

Internal vs External Financial Reporting Financial reporting is a critical aspect of any organization's communication strategy, serving as a bridge Read More

Difference Between Equity Funds and Mutual Funds by EduPristine

Understanding the Difference Between Equity and Mutual Funds Equity investment and mutual fund investment are both popular choices for long-term Read More

Navigating the ACCA Career Landscape with EduPristine

Navigating the ACCA Career Landscape: Opportunities in India and Beyond Hey there, so good to have you back again! In Read More

Chief Financial Officer (CFO): A Complete Guide | EduPristine

Chief Financial Officer (CFO): A Complete Guide In the dynamic domain of corporate governance, one figure stands out as the Read More

All About Merger and Acquisition by EduPristine

Merger and Acquisition (M&A)? Its What, Why, and When What is M&A? When people hear that a company has taken Read More

What is Income Tax? Part Two by EduPristine

What is Income Tax? Part Two Income tax stands as a pillar of India's economic framework, shaping financial dynamics and Read More

Understanding the Basics of Direct Taxation with EduPristine

Understanding the Basics of Direct Taxation Hey there, so good to have you back again! In the realm of accounting, Read More

The Crucial Role of Ethics in Management Accounting | EduPristine

The Crucial Role of Ethics in Management Accounting Hey there so good to have you back again! Have you ever Read More

What is Income Tax? Part one by EduPristine

What is Income Tax? Part One Income tax serves as a cornerstone in India's financial landscape, wielding significant influence over Read More

Financial Reporting vs. Financial Accounting by EduPristine

Financial Reporting vs. Financial Accounting: Understanding the Basics In the world of business and finance, two key terms often come Read More

How Do Firms Manage Financial Risk | EduPristine

How Do Firms Manage Financial Risk? Managing financial risk is a crucial responsibility for firms in today's dynamic business landscape. Read More

Financial Accounting and Types of Financial Statements | EduPristine

What is Financial Accounting? Exploring Types of Financial Statements Welcome to our exploration of Financial Accounting, a fundamental pillar of Read More

Managerial Accounting- Its Meaning, Process and Types | EduPristine

What is Managerial Accounting? Its Meaning, Process and Types Hello and welcome to the world of managerial accounting—a practical and Read More

A Guide on Project Finance by EduPristine

A Guide on Project Finance In the dynamic landscape of finance, where innovation and strategic thinking converge, one area that Read More

Why do Finance Professionals use Power BI | EduPristine

Why do Finance Professionals use Power BI? Hey there, so good to have you back again! Have you ever found Read More

Macroeconomics: Meaning, Process, and Indicators | EduPristine

Macroeconomics: Meaning, Process, and Indicators Welcome back, students! Today, we're delving into the world of macroeconomics. In this blog, we'll Read More

Internal Audit- Meaning, Objectives, Types and Importance by EduPristine

Internal Audit- Meaning, Objectives, Types and Importance In the world of business, where things can get pretty complex, there's a Read More

A Simple Guide on Quantitative Analysis- EduPristine

What is Quantitative Analysis? A Simple Guide In the ever-changing world of finance, where data holds immense power and decisions Read More

Five Basic Principles of Accounting by EduPristine

What are the Five Basic Principles of Accounting? In the world of finance and business, accounting stands as the backbone, Read More

Internal Controls: Meaning, Types, and Importance by EduPristine

Internal Controls: Meaning, Types, and Importance In the domain of business management, Internal Controls stand as the silent guardians ensuring Read More

Basics of Accounting – Meaning and Basics Concepts | EduPristine

Basics of Accounting - Meaning and Basics Concepts Welcome to the world of Accounting 101 - where numbers tell a Read More

The Different Business Functions by EduPristine

What are the Different Business Functions? In the dynamic landscape of commerce, businesses are intricate entities composed of various interconnected Read More

The Different Types of Business Structures | EduPristine

What are Different Types of Business Structures? In the ever-evolving world of business, the key to sustained success goes beyond Read More

The Vital Role of Cost Management for US-CMAs | EduPristine

The Vital Role of Cost Management for US-CMAs Hey there, so good to have you back again. Have you ever Read More

Role of Ethics and Professionalism in the Investment Industry

Role of Ethics and Professionalism in the Investment Industry In the dynamic landscape of the investment industry, where fortunes are Read More

The Risk Management Process: Essential Steps | EduPristine

The Risk Management Process: Essential Steps In the dynamic landscape of business and finance, uncertainties are inevitable. Every decision, venture, Read More

ACCA vs CPA: Choosing the Right Path for Your Career | EduPristine

ACCA Certification vs. CPA Course: Choosing the Right Path for Your Career Embarking on a career in accounting opens a Read More

Transforming Aspirations into Achievements: CPA Course Excellence

CPA Course Excellence: How EduPristine's Approach Transforms Aspirations into Achievements Embarking on the journey to become a US Certified Public Read More

Comprehensive Guide to ACCA Certification with EduPristine

Unlocking Global Opportunities: A Comprehensive Guide to ACCA Training in India with EduPristine Welcome to your roadmap for global success Read More

CPA Course Decoded: Achieve Success with EduPristine Training

CPA Course Decoded: Achieve Success with EduPristine's Expert-Led Training Embarking on the journey to become a US Certified Public Accountant Read More

US CMA Course: A Step-by-Step Preparation Guide by EduPristine

Master the US CMA Course: A Step-by-Step Preparation Guide by EduPristine Hey there future US CMAs! If you're thinking about Read More

Key Reasons Why Upskilling is Important

As we navigate the challenging yet exciting journey of studying finance and accounting, we wanted to share some valuable advice Read More

All About Evolving Aviation Industry

India’s aviation industry has witnessed significant transformations in recent years, with the emergence of low-cost carriers, the expansion of domestic Read More

How India’s Digital Payment Revolution is Reshaping the Economy

Hey there! So good to have you back again. In this blog, we will discuss the recent developments, explore the significance, Read More

Understand the catastrophic impact of a possible US Debt Default

Hello there! Welcome to our new blog. In this blog post, we will explore the potential catastrophic effects of a Read More

RBI Bids Farewell to Rs. 2000 Notes

Hello there! Welcome to our new blog. In this blog, we will explore the recent decision by the Reserve Bank Read More

Key Insights from the Economic Survey 2022-2023

Hello there, students! How have you been? Today, we will explore more about the recent economic survey, 2022-2023. Economics Read More

What is Digital Marketing? What is the objective?

Hey there! Ever wondered what is the main objective behind practicing digital marketing techniques? Digital marketing has now become a Read More

Why you must consider being a Certified Management Accountant

Hey there! So good to have you back again. Are you someone who loves planning, analyzing, and adjusting monthly Read More

Key Insights from the Economic Survey 2022-2023

Hello there, students! How have you been? Today, we will explore more about the recent economic survey, 2022-2023. Economics plays Read More

What is Digital Marketing? What is the objective?

Hey there! Ever wondered what is the main objective behind practicing digital marketing techniques? Digital marketing has now become a Read More

Why you must consider being a Certified Management Accountant

Hey there! So good to have you back again. Are you someone who loves planning, analyzing, and adjusting monthly budgets? Read More

All About Classroom Training vs Online Training

Hello there, students! How have you been? Today, we will explore more about the recent economic survey, 2022-2023. Economics plays Read More

All About Axis-Citi Acquisition

A significant move initiated by Axis Bank, India’s third largest private sector lender, to acquire Citibank’s retail business has become Read More

Can vernacular edtech ever become mainstream?

Hey there! Glad to have you back again. Did you know that with the next half billion students coming from Read More

Indian start-ups need to start taking corporate governance seriously, why?

Hey there! Glad to have you back again. Wondering why Indian start-ups require corporate governance? If yes, then this blog Read More

How to Level up the Overall Digital Marketing Strategy?

Hello there! So good to have you back. Did you know that more than half of the brands today either Read More

Snapchat for Business

Hey there! Welcome back again. In this blog, we will understand how to use Snapchat for businesses to stand out Read More

What will Digital Marketing Look like in the Next 20 years?

Hey there! Do you wonder what digital marketing will look like in the next 20 years? If yes, then this Read More

Importance of Soft Skills

Hey there! So good to have you back again. In this blog, we will understand the top 5 skills and Read More

Why are Mr. Men and Little Miss characters all over the social media?

Hey there! Welcome back again. If you’re on social media, you must have probably come across Mr. Men and Little Read More

How global firms are looking at the Indian investment market

Hey there! So good to have you back again. Wondering, how the global firms are looking at the Indian investment Read More

Role of Keywords in Digital Marketing

Hey there! Welcome back again. Did you know that a proper keyword search lies at the heart of a successful Read More

All About the Social Media Careers and the Skills to be Mastered

Hey there! Happy to have you back again. Did you know that social media careers are taking off? Well, social Read More

All About Leadership in a Multicultural World

Hey there! Welcome back again. Ever wondered what a global mindset is? If yes, then this blog is a must-read Read More

All about Metaverse and why is metaverse important for brands?

Hey there! Welcome back again. Wondering what exactly Metaverse is? Is it a video game? Or is it just another Read More

Why will the Netflix business model need more than just a quick fix?

Hey there! So good to have you back again! Wondering why the Netflix model will take more than just a Read More

Financial Models and How to Create them Effectively

Hey there! So good to have you back again. In this blog, we will understand how Finance Professionals can create Read More

Top 5 Digital Marketing Trends to be Followed

Hey there! So good to have you back again. Wondering what marketers have been doing so far in 2022? If Read More

Best Practices for Financial Management

Hey there! So good to have you back again. In this blog, we will discuss a few essential tips for Read More

How did the crisis in Sri Lanka impact India?

Hey there! Welcome back again. In this blog, we will discuss how the crisis in Sri Lanka is impacting India. Read More

Objectives of Risk Management

Hey there! So good to have you back again. In this blog, we will answer the most frequently asked question, Read More

Career Options After Qualifying for the US CMA Course

Hey there! So good to have you back again. Are you curious and want to learn more about the job Read More

Skills That Make You Proficient in Digital Marketing

Did you know that digital marketing is a dream job for many people today? Let us find out why? If you are Read More

What Are The Different Types of Financial Markets?

Hey there! Welcome back once again. In the last few blogs, we discussed the financial markets and their functions. We Read More

How Indian Students Can Pursue the US CPA?

Hey there! So good to have you back again! Are you also wondering how can Indian students acquire the international Read More

Equity Derivatives and Benefits of Equity Derivatives

Hey there! Welcome back again. Ever wondered what are Equity Derivatives? If yes, then this blog is a must-read. Equity Read More

What are Black Swans in Risk Management?

Hey there! So good to have you back again. Are you wondering what the term “Black Swans” in risk management Read More

Will Digital Marketing Replace Traditional Marketing?

Hey there! Welcome back again. One of the most frequently asked questions we often get is, will digital marketing ever Read More

Functions of Financial Markets?

Hey there! Welcome back to another blog on finance. In the previous blog, we discussed what are financial markets and Read More

How to Calculate GST (Goods and Services Tax)?

Hey there! So good to have you back again. Are you also keen on learning how to calculate GST? If Read More

Why are Financial Markets Regulated?

Hey there! Welcome back again. Are you also curious and wondering why are financial markets regulated and why are they Read More

Does an Accountant Need an MBA?

Hey there! Welcome back again. Are you the one among others who is confused and want to know whether an Read More

Why is ACCA Not Recognized in The USA?

Hey there! Welcome back again. Have you ever wondered why is the ACCA course not recognized in the USA, but US CPA Read More

Is the US CMA Course Appropriate for Working Professionals?

Hey there! Are you a working professional and want to pursue the US CMA course simultaneously while working full time? If yes, Read More

What is a Derivative?

Derivatives are financial contracts that derive their value from the performance of an underlying asset, or group of assets, or Read More

What is Derivative Market?

Did you know that derivatives are also considered advanced investing? Well, derivatives can be called secondary securities whose value is Read More

Types of Acquisitions

Hey there! Welcome back once again. Have you ever wondered why do many acquisitions succeed just as many who fail? Read More

Types of Mergers

Hey there! Welcome back again. In the previous blog, we discussed what are mergers and acquisitions. In this blog, we Read More

What are Mergers and Acquisition?

Hey there! Welcome back again. Mergers and Acquisition sound quite familiar right? But ever wondered why are Mergers and Acquisitions Read More

Do Indian Companies Hire CFA’s?

Hey there! So good to have you back again. Are you planning to do CFA and wondering whether Indian companies Read More

What Should I Study, US CMA or Digital Marketing?

Hey there! Welcome back again. Are you confused and wondering which course to study, US CMA or Digital Marketing? Well, Read More

Types or Methods of Business Valuation

Hey there, Welcome back again. Let us understand what business valuation is and its different methods. Let us get started. Read More

What is GST? What Are The Career Opportunities in GST (Tax domain)?

The tax system in India has undergone tremendous changes since the introduction of GST. GST stands for Goods and Services Read More

How to Manage Risks in a Business?

Hey there! Welcome back again. Do you know one of the most critical factors to be kept in mind while Read More

How to Work On a Digital Marketing Project for Practice?

Hey there! Welcome back to another blog. We will be discussing the tips on how to work on a digital Read More

What is Digital Marketing? What is the objective?

Hey there! Ever wondered what is the main objective behind practicing digital marketing techniques? Digital marketing has now become a Read More

Is CA the only optimal career option for commerce graduates?

Are you also thinking about what is next after B.Com? Is pursuing CA the only option for commerce graduates? Let Read More

All about the US CPA course

Topic: Is CPA preferable after CA? Are you a qualified Chartered Accountant and wondering what is next after CA? If Read More

In your opinion, what makes a good Financial Model?

Are you aware that a good financial model can help multiple start-ups and small businesses? With this, now let us Read More

What is Business Valuation?

Business valuation is the general process or result of determining the economic value of a company or a whole business or Read More

Does CFA has any scope in India?

Is it worth becoming a CFA (Chartered Financial Analyst)? Is it worth investing nearly three years, spending about 900 study hours, and Read More

Career Advice: Is doing the ACCA over a CA a better option?

Hey there! So good to have you back again. This blog is mainly for those who are confused regarding which Read More

Which is a Better Career Option, CFA or FRM?

Hey there! Welcome to another blog where we discuss which course is better, the CFA course or the FRM course? We will be Read More

What is the procedure for enrolment for the CPA program for beginners?

Hey there! So good to have you back again. Well, if you are planning to pursue the CPA course then Read More

How Do People Judge the Quality of Financial Modeling?

Hey there! Welcome back again. Are you also wondering what is Financial Modeling, that everyone in the finance industry keeps talking Read More

What is the Reality of a Career in Digital Marketing?

Hey there! Welcome back again. Do you wish to get better clarity on what is the actual reality of a Read More

Which is Better CMA or CIMA?

CMA and CIMA sound quite similar right? Are they the same? Are you also confused and wondering which one is Read More

Is CFA in India Good for a Career?

Hey there! Welcome back again. Are you thinking about how good is the CFA as a career option in India? Let’s deep Read More

I Desire to Get an ACCA Degree, but the Tuition is too Expensive. Why is the ACCA Course Expensive?

Hey there! So good to have you back again. Today, we will be answering the most frequent question which is, Read More

Are There Any Job-Oriented Courses After Completing Graduation?

Hey there! Congratulations on completing your graduation. Are you now ready and excited to pursue job-oriented courses that will help you secure Read More

Is Financial Modeling from EduPristine Worth It?

Hey there! Welcome back again. Let me begin by asking you a very simple question which is, did you know Read More

Does Digital Marketing Have a Great Future Ahead?

Why Digital Marketing course is trending and has so much demand? What topics are covered under the Digital Marketing course syllabus? Is Digital Marketing Read More

What are the Benefits of Pursuing FRM Course(GARP)?

You must have heard about the term FRM or Financial Risk Manager several times, but ever wondered what exactly is FRM, how Read More

What is the Syllabus for CPA Course? Is it the Same as CA or Different?

Hello there! Welcome back again. Are your curious minds also wondering whether the syllabus for the US CPA course is similar to Read More

What are The Top Skills a Commerce Student Must Have?

Hey there! So good to have you back again. Did you know companies are more inclined towards selecting candidates who Read More

What are the Benefits of Learning Financial Modeling?

Do you ever wonder what does a Financial Modeler do? Some of you might also want to become a successful Read More

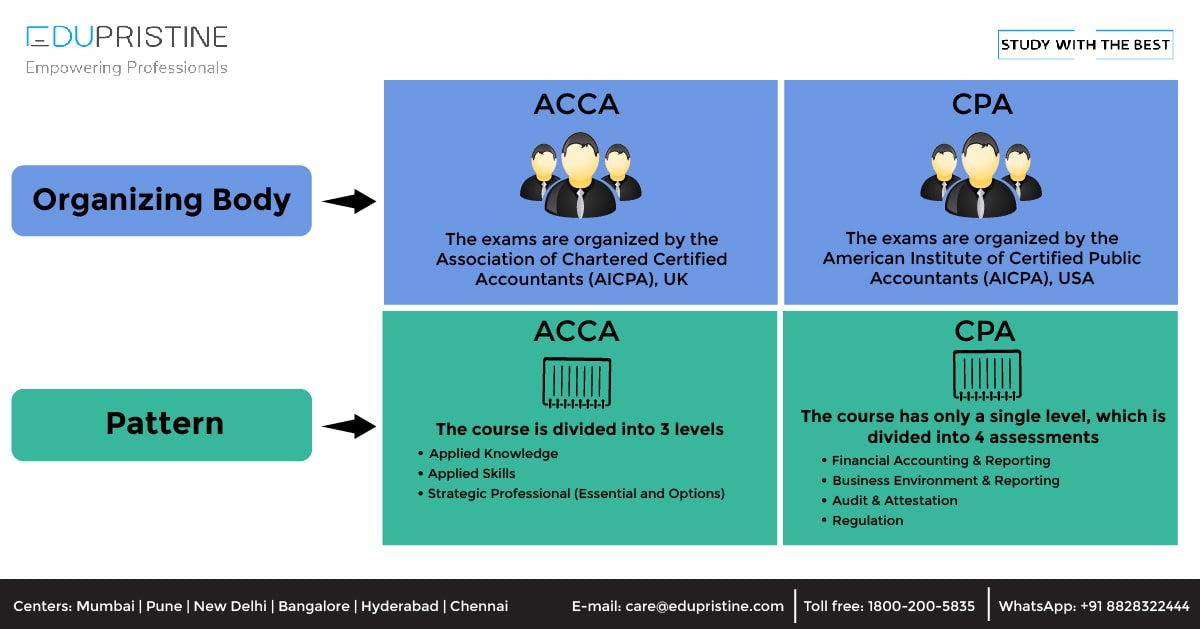

What is the difference between ACCA and CPA?

Accounting is a field that has endless job opportunities. It is the backbone of an organization. Be it any industry, Read More

5 Reasons why you should pursue the CPA course after CA

CPA course, also known as Certified Public Accountant (CPA), is a globally recognized designation and is the highest standard of Read More

How Opting for Full-Time Level I CFA Course Gives You an Edge Over Others

Chartered Financial Analyst (CFA course) is one of the most in-demand certifications in the field of finance and provides lucrative Read More

A Complete Guide on ACCA Course Eligibility, Duration, Registration, Fees, Etc.

Why the ACCA course? ACCA is a global professional accounting body offering the Chartered Certified Accountant qualification (ACCA) and is Read More

CPA Exam Registrations and Scheduling in India

CPA Exam Registration CPA stands for Certified Public Accountant and is one of the major certification courses in the field Read More

What is Soft Skill Training ?

What is Soft Skill Training With the evolution of the business and client servicing industry, soft skills have started gaining Read More

What is Finance: Types of Finance and Financial Instruments?

Finance is a major and vast topic to cover. Accounting and Finance are often used together, and some even deem Read More

All you want to know about Chartered Accountant (CA)

Here's what you need to get started with the Chartered Accountant (CA) course Chartered Accountant is an honorable designation that Read More

Soft Skills For The Hard World

Soft Skills Training - Reality Check: Whether we'™re talking in a team meeting or presenting in front of an audience, Read More

What is the Importance Of Relative Valuation

Relative Valuation Generally speaking, ‘valuation’ can be defined as the process for finding the ‘value’ of anything. In the world Read More

Ratio Analysis – Ratios Formulae

Ratio analysis'”the foundation of fundamental analysis'”helps to gain a deeper insight into the financial health and the current and probable Read More

Excel Tricks: Text Functions in Excel

How to use Text Functions in Excel Excel is mostly about the numerical data, but at times you can Read More

Explore the Top 12 Opportunities Which Will Take Your Career to the Next Levet [2020 – 2021]]

While writing the last paper of your final B.Com exam, a plethora of thoughts go through your mind. A lot Read More

Top 10 Accounting Firms

Over the years, the way of doing business has changed significantly. There are a number of factors which have contributed Read More

Everything you want to know about the CMA certification

CMA Full Form: Certified Management Accountant (CMA) Going for the CMA certification is a great career move, especially when you Read More

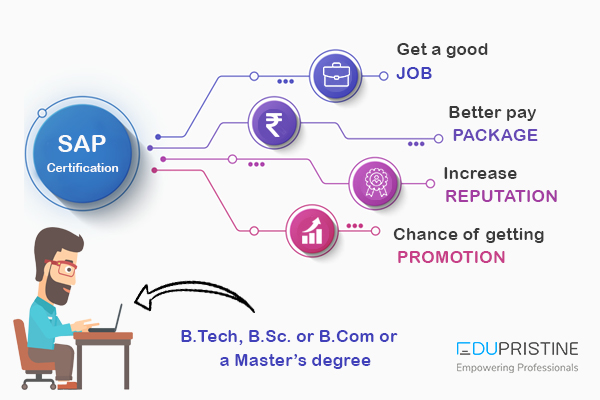

SAP certification – examination, eligibility and benefits

SAP certification help validate the expertise and experience of SAP partners, software users, customers and professionals who are looking to Read More

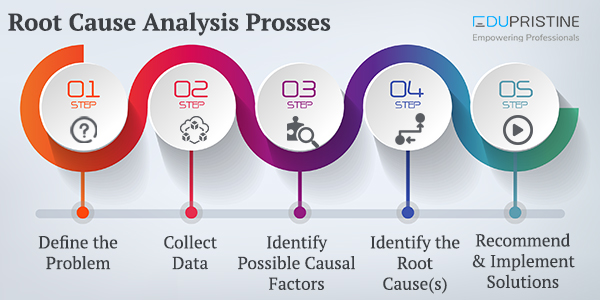

Root Cause Analysis

As the name suggests, Root Cause Analysis deals with identifying the origin of a problem and finding a solution for Read More

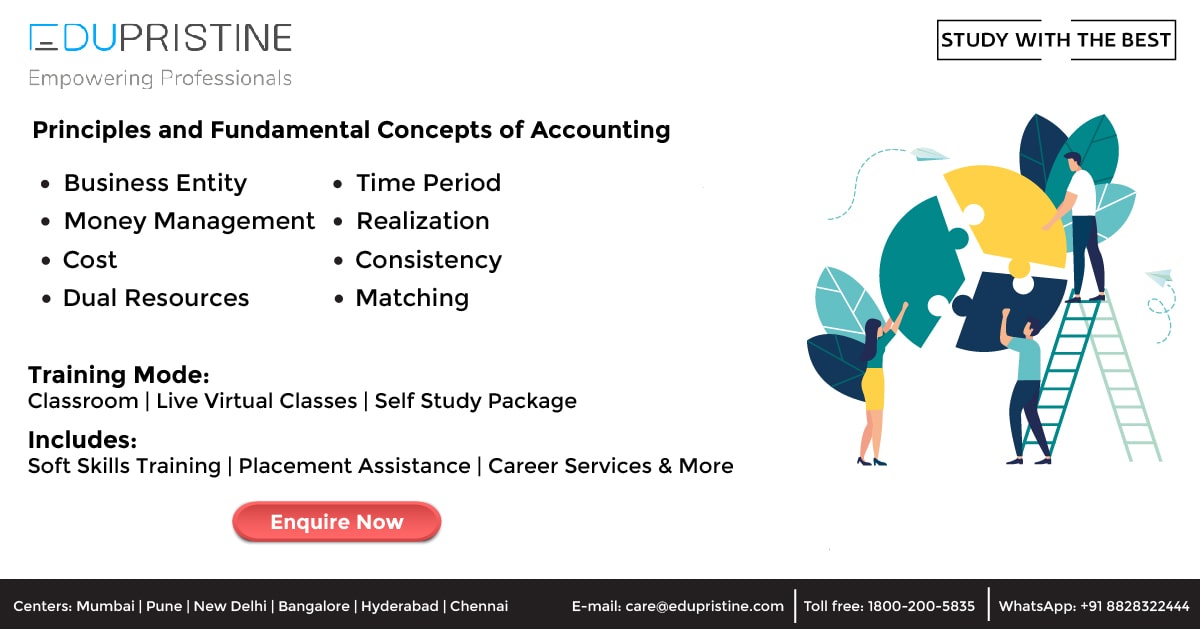

Principles and Fundamental Concepts of Basic accounting

Accounting is extremely popular as the language of business language. Through this language, it is easy to analyze the financial Read More

Know how to understand and interpret cash flow statement

A cash flow statement is essential to any business as it can be the basis of budgeting by assessing the Read More

ALL YOU WANT TO KNOW ABOUT SENSITIVITY ANALYSIS

The Crucial Role of Sensitivity Analysis: Hey there, so good to have you back again. Have you ever wondered how Read More

ACCA Full Form

ACCA - Association of Chartered Certified Accountants The role of strategic academic guidance in the life of a student is Read More

FINDING AND REMOVING DUPLICATES IN EXCEL

FINDING AND REMOVING DUPLICATES IN EXCEL Have you ever encountered a situation where you see a lot of duplicated data Read More

Capital Budgeting: Techniques & Importance

In our last article, we talked about the Basics of Capital Budgeting, which covered the meaning, features and Capital Budgeting Read More

Importance of Business Accounting for enterprises

Introduction: Importance of Accounting to your business The term Accounting is a very common one and we hear about the Read More

Amalgamation Explained in detail

AMALGAMATION EXPLAINED IN DETAIL Understanding Amalgamation: Exploring the Dynamics of Corporate Unions Have you ever wondered what truly defines the Read More

Working Capital Management

What is Working Capital Management? Traditionally, investors, creditors and bankers have considered working capital as a critical element to watch, Read More

STATISTICAL FUNCTIONS IN EXCEL

STATISTICAL FUNCTIONS IN EXCEL People usually have love-hate relationship with statistics. When you get your formulas right you are in Read More

Venture Capital

Unlocking the power of Venture Capital: Features, Financing Methods, and Opportunities Hey there, so good to have you back again! Read More

Financial Reporting

In any industry, whether manufacturing or service, we have multiple departments, which function day in day out to achieve organizational Read More

Cell References in Excel

While using excel, there may be times when you want to keep the values same while copying formulas. This can Read More

Costing Methods & Important Cost Terms

Costs can be simply defined as the money or resources associated with a purchase / business transaction or any other Read More

Balance sheet explained in detail

What is Balance Sheet? A balance sheet (also called the statement of financial position), can be defined as a statement Read More

Cash Flow Statement

CASH IS KING;is a known fact, that it is the basis of any business. No bills, employees or for that Read More

What are the career options after Mcom

Master of Commerce or M Com is a postgraduate Master Degree which specializes in commerce, accounting, management and economics related Read More

WHAT IS STANDARD DEVIATION?

WHAT IS STANDARD DEVIATION? In finance and investment, understanding and managing risk is of paramount importance. Among the tools available Read More

Know how effective is CMA course compared to MBA in providing a dream job

There are various industries and sectors out there where you can grow and enhance your career. Management, Accounting, Finance, Engineering, Read More

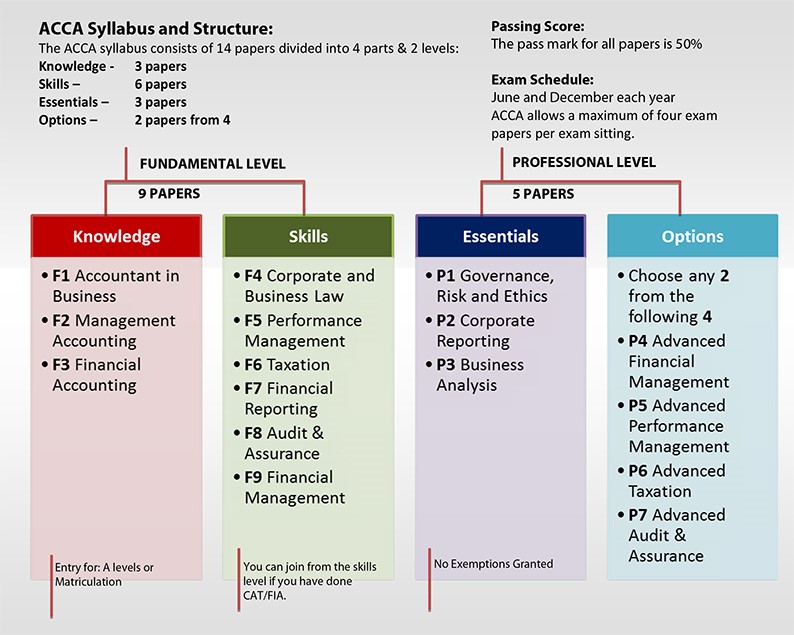

ACCA EXAM STRUCTURE AND PATTERN

ACCA EXAM STRUCTURE AND PATTERN Understanding the ACCA exam structure and pattern is essential for individuals aspiring to pursue a Read More

Comparison of CPA course with other courses

The Accounting industry offers you various opportunities to learn via various courses. You can choose which one suits your academic Read More

Advantages and Application Process of FRM

FRM (Financial Risk Manager) Certification gives you a distinctive edge from the other risk management professionals operating in the Finance Read More

An insight into OTC Derivatives

What is Derivatives? Derivatives are defined as the type of security in which the price of the security depends/is derived Read More

CPA Course Syllabus – Topics and Importance

A CPA requires a broad spectrum of knowledge and proficiency in it. The purpose of CPA exam syllabus is to Read More

CFA® Study Planner

Most of the CFA® pursuers believe that CFA® Program tests are very difficult and arduous but that is not the Read More

CPA Course details, application fees and benefits of doing it

A Certified Public Accountant (CPA) is the highest standard of competence in the field of Accountancy across the globe. The Read More

All Important About CFA® LEVEL 1 Syllabus

CFA® charter is one of the most exalted credentials of those who work in the financial sector or who make Read More

All about Portfolio Management

What is a Portfolio? A portfolio can be defined as different investments tools namely stocks, shares, mutual funds, bonds, cash Read More

Cost Management: Meaning, Techniques & Advantages

What is Cost? Cost is defined as the monetary valuation of effort, material, resources, time consumed, risk and opportunity forgone Read More

How to get into Big 4 Accounting Firms?

We all have some career objectives and aspirations. For higher studies like MBA, CA, CPA, ACCA, CFA etc. one has Read More

FRM Question Bank

For every exam, time management is very important and everyone wants a precise course content in a prioritized manner along Read More

Top 10 Companies that hire CFA® Charterholders

A lot of hardwork and investment is required to prefix the words CFA® Program before your name and time and Read More

Income Statement in detail

WHAT IS INCOME STATEMENT? The income statement is one of the important primary financial statements provided by organizations. It presents Read More

KPIs for Business Analysts

A business analyst's role in an IT project is to ensure that all requirements of the client are captured and Read More

Annual Report

What is an Annual Report: The single source of getting information about any company whether it is the past or Read More

Capital Budgeting

WHAT IS CAPITAL BUDGETING? Capital budgeting is a company’s formal process used for evaluating potential expenditures or investments that are Read More

Mergers and Acquisitions

What is Mergers & Acquisitions? Mergers and acquisitions (M&A) are defined as consolidation of companies. Differentiating the two terms, Mergers Read More

Detecting Multicollinearity

" In my previous blog “ How to deal with Multicollinearity ”, I theoretically discussed about definition of multicollinearity and Read More

ANALYSIS OF FINANCIAL STATEMENT OF A COMPANY

ANALYSIS OF FINANCIAL STATEMENT OF A COMPANY One of the major aspects of making a sound investment decision is analyzing Read More

8 Excel functions that every Data Analyst must know

Are you a data analyst or looking for a career as a data analyst??? Well then, today's article is dedicated Read More

Duckworth-Lewis Method

Duckworth-Lewis method(D/L method) is a mathematical function defined to set and calculate the target score for the team batting second Read More

6 Most Common Excel Errors

Hashtags look cool when seen on Twitter or Facebook but as soon as they start appearing in Excel sheet, you Read More

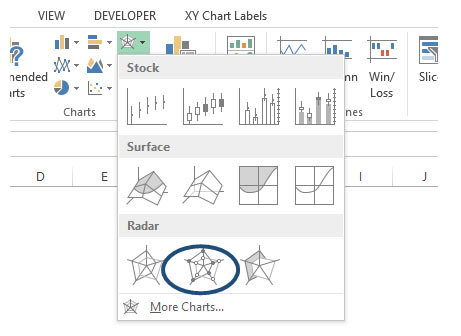

RULE PRECEDENCE IN CONDITIONAL FORMATTING

RULE PRECEDENCE IN CONDITIONAL FORMATTING Conditional Formatting in Excel makes tasks easier and more user-friendly but it can sometimes be Read More

Types of Investment Banking jobs

Investment banking is one of the most attractive industry to work in. not only for people with formal education in Read More

FRM Part 1 syllabus

Shut your doors, drop the drapes on your windows and don't bother looking at the clock because it's always the Read More

Ratio Analysis – Introduction

Introduction The term 'ratio analysis'refers to the analysis of the financial statements in conjunction with the interpretations of financial results Read More

Ratio Analysis – Classification of ratios and Liquidity Ratio

In our previous blog post we discussed ratio analysis. In this blog post we will explain classification of ratios and Read More

Bootstrapping Solution

What is the Bootstrapping method? Bootstrapping is a method for constructing a zero-coupon yield curve from the prices of a Read More

Dell’s Leveraged Buyout: A Real-life Case Study

Acquisitions Acquisitions or takeovers are a transaction or process wherein one company (commonly called as acquirer) or an investor acquires Read More

CASH FLOW STATEMENT: LEARN TO CREATE CASH FLOW STATEMENT TEMPLATE IN EXCEL

CASH FLOW STATEMENT: LEARN TO CREATE CASH FLOW STATEMENT TEMPLATE IN EXCEL Welcome to our following how-to guide: How to Read More

Leave a Reply