One such course which is highly in demand is the PGP-BAT course. Any candidate who has completed B.Com is eligible to pursue this course which is a post-graduation program in the field of Accounting and Taxation. It is a very structured course that is designed and curated by industry experts having gained expertise in Accounting and Taxation. The PGP-BAT course details are as follows:

This course has a total of nine modules which are as follows:

1) The very first module consists of Basics of Accounting and Accounting in Tally.

2) The second module consists of the basics of GST and GST in Tally.

3) The third module is all about the basics of income tax and income tax in Tally.

4) Payroll and its components are covered under the fourth module.

5) The fifth module teaches more about excel for Accounting and MIS.

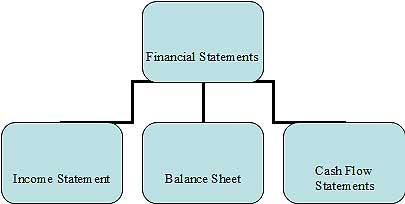

6) The sixth module comprises of finalization of financial statements.

7) How to set up a BUSY software is taught in the seventh module, wherein you learn about BUSY practicals.

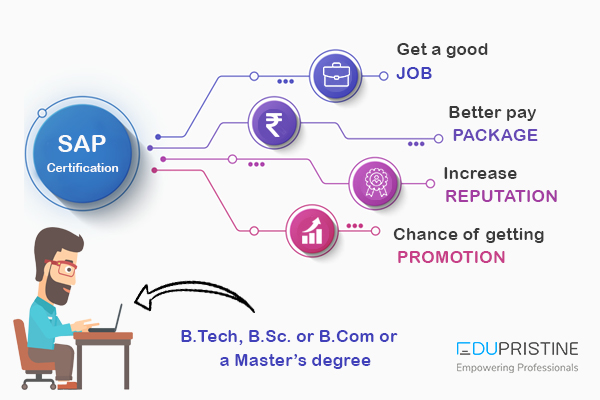

8) The eighth module teaches about SAP in which the FICO module is covered.

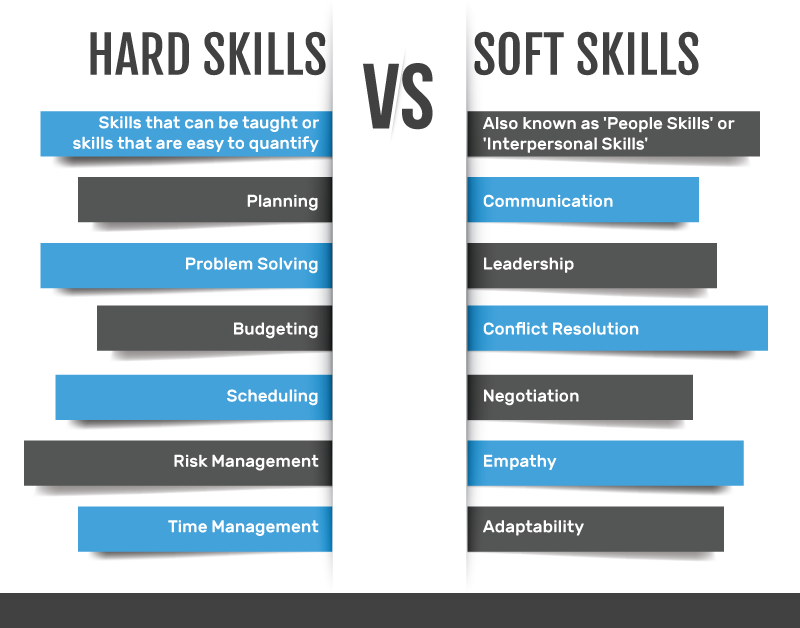

9) The very last module is all about Soft Skills. Soft Skills are very important for all professionals be it in any sector. Soft Skills are an essential part and help in improving one’s ability to work with others and having a positive influence, which helps in career advancement.

The PGP-BAT course is not only for recently graduated B.Com graduates but also for those who have 0-2 years of work experience and want to make a shift from a clerical role towards a more strategic role.

Sounds interesting right? With this, you might also be wondering about the PGP-BAT course duration. Well, this depends on a candidate’s focus and the amount of time invested. On average, it takes a minimum of five months to complete this program.

The PGP-BAT course salary in India starts from two lakhs per annum which can go up to ten lakhs per annum. The various job roles one can expect after completing the PGP-BAT course are account executive, account assistant, senior assistant, accounts manager, senior manager, and finally DGM/GM.

Coming to the frequently asked question that is, where should you study from?

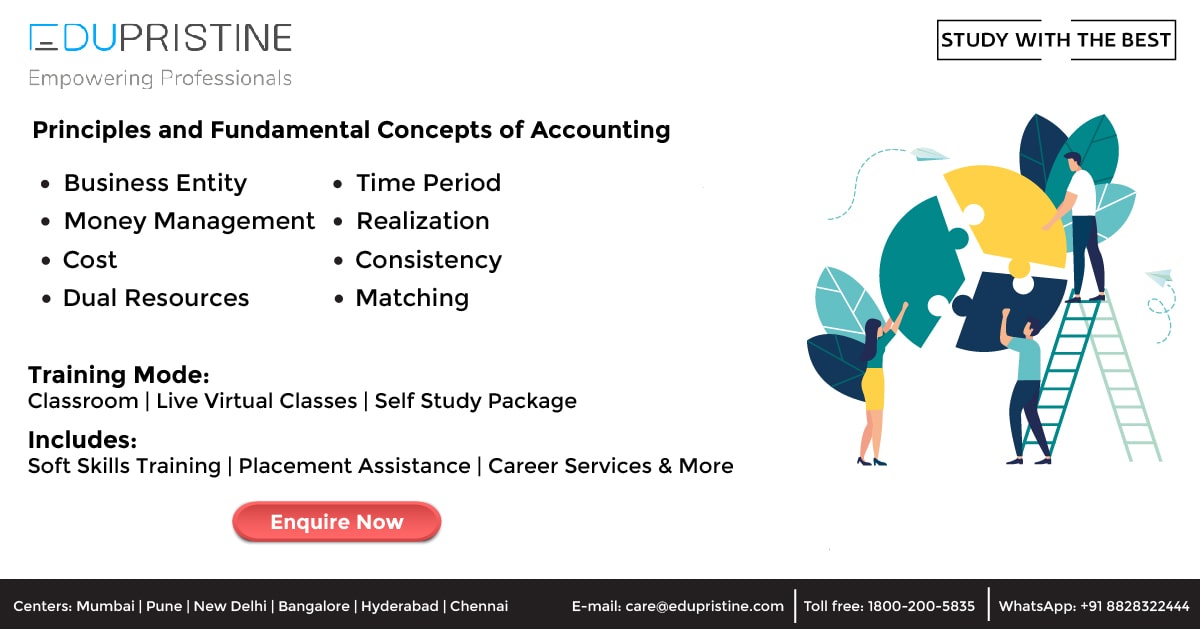

1) An institute that focuses on students’ success and helps them provide multiple job opportunities after completion of the program.

2) An institute that provides Soft Skills training and Career Services support by preparing students for interviews and job challenges.

3) An institute that provides multiple learning options to suit student requirements like full-time training etc.

4) An institute that provides flexibility to switch to another mode of training as per convenience. Like having an option to move between classroom and LVC at your convenience.

Other frequently asked questions are:

1) What skills are required to build a successful career in the field of accounting?

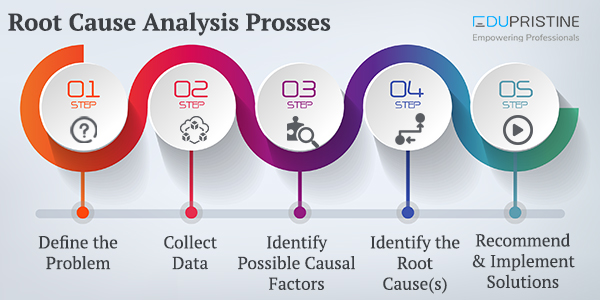

Ans: Certain skills are very helpful in building a successful career. These skills are problem-solving, analytical skills, project management skills, research skills along with the ability to lead, motivate, and great communication skills.

2) Is it worth doing the Business Accounting and Taxation course?

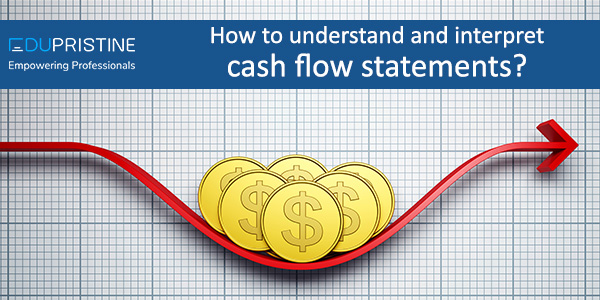

Ans: The answer is a very big yes. This is because accounting and taxation are very important domains. Having expertise in these domains can help in securing high-paying jobs in any industry. One can interpret and make financial plans that in turn helps in converting bookish knowledge to practical implementation.

3) Will I have to study accountancy to understand taxation?

Ans: Candidates need to have a decent knowledge of financial accounting to be able to compute taxable income for both individuals and business firms. Along with this, preparation of accounts and finalizing the balance sheet will also be required.

We hope this information helps you make the right career choice. If you have any further doubts or queries, you can contact our counsellors, who would be more than happy to help you make the right choice. All the best and happy learning.

Leave a Reply