Let us now understand what is the major difference between merger, acquisition, and takeover?

Well, Merger describes a transaction where both the business parties involved come together and combine the operations to form a brand-new business entity. On the other hand, an acquisition describes a transaction where both the business entities co-operate. Takeover arises where the target business entity opposes the transaction.

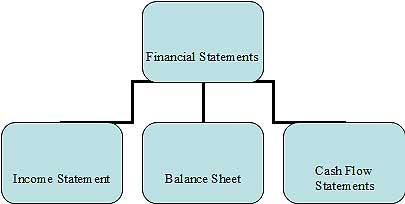

Post-acquisition, the parent company usually must go through acquisition integration which is the process of integrating all the systems and operations of the target company with the parent company. The parent company is also required to follow acquisition accounting guidelines, which is a branch of financial accounting that describes how assets, liabilities, and goodwill should be reported by the buyer on its consolidated financial statements.

If you want to learn such topics in detail, then you must enroll in theFinancial Modeling course that will cover financial modeling and valuation in detail. So, what is the Financial Modeling course? Financial Modeling is a course designed for candidates to develop core skills that are required for profiles like Investment Banking, Portfolio Management, Equity Research, Credit Research, etc. This is a very crucial skill to acquire, majorly for those you wish to build a successful career in the field of finance. To know more, please feel free to contact our counsellors, who would be more than happy to assist you. All the best and happy learning.

Leave a Reply